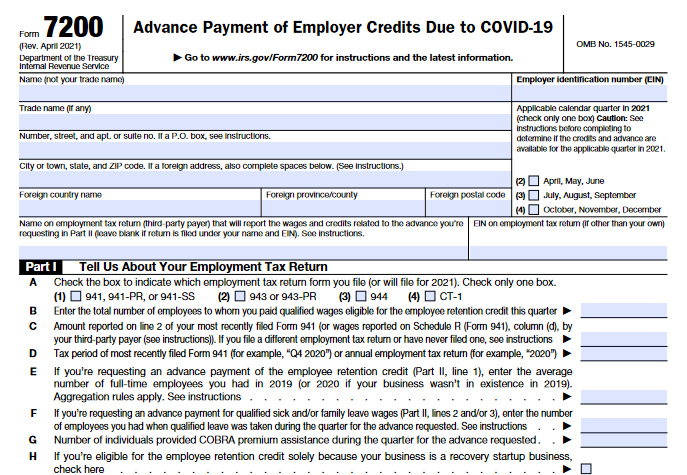

What is IRS Form 7200?

IRS Form 7200, (Advance Payment of Employer Credits Due to COVID-19) is used by qualifying employers to request an advance payment of the tax credits for qualified sick and qualified family leave wages, and the employee retention credit that they claim in their federal tax returns.

The eligible tax credits for a quarter usually are greater than the amount of employment tax deposits due by the employer for the quarter. In this case, the employer can file Form 7200 to request the advance payment from the IRS of the excess credits before filing the Employment Tax Return.

By filing Form 7200, qualifying employers can claim the advance payment on credits otherwise claim on the employment tax returns listed below.

- Form 941, Employer’s QUARTERLY Federal Tax Return.

- Form 941-PR, Planilla para la Declaración Federal TRIMESTRAL del Patrono.

- Form 941-SS, Employer’s QUARTERLY Federal Tax Return (American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands).

- Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees.

- Form 943-PR, Planilla para la Declaración Anual de la Contribución Federal del Patrono de Empleados Agrícolas.

- Form 944, Employer’s ANNUAL Federal Tax Return.

- Form 944(SP), Declaración Federal ANUAL de Impuestos del Patrono o Empleador.

- Form CT-1, Employer's Annual Railroad Retirement Tax Return.

Don't reduce your deposits and request advance credit payments for the same expected credit. You will need to reconcile your advance credit payments and reduced deposits on your employment tax return.

Click here to learn more about Form 7200.

What are the changes in Form 7200 for Quarter 2, 2021?

The IRS has made some changes to the Form 7200 for 2021. The following lines are introduced for the 2021 tax year,

- Enter the total number of employees who are provided with qualified wages for the employee retention credit in line B

- Line G is entered with the number of individuals provided COBRA premium assistance

- Check the box in Line H if the business is a recovery startup business and eligible for employee retention credit

- Line 4 of Part II is to enter the total COBRA premium assistance provided

Visit https://www.taxbandits.com/form-7200/file-form-7200-online/ to learn more.

Who needs to file IRS Form 7200?

Businesses and tax-exempt organizations that file an employment tax return(s) form 941, 943, 944, or CT-1 may file Form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee retention credit. You need to reconcile any advance credit payments and reduced deposits on your employment tax return(s) that you will file for 2020.

What Information is Required to complete Covid19 Form 7200?

-

Employer Details:

- Name, EIN, and Address

-

Employment Tax Return Details:

- Form 941/943/944/CT-1

- Amount reported recently

- Total number of employees

- Credits and Advance Request Details

Visit https://www.taxbandits.com/form-7200/form-7200-instructions/ to learn more about Form 7200 Line by Line Instructions.

How to Fax IRS Form 7200?

The simple way to apply for your Covid19 tax relief

Step 1

Enter your Employer Details

Step 2

Enter your Employment Tax Return Details

Step 3

Enter your Credits and Advance Requested

Step 4

Send it to the IRS

by FAX

Complete and Fax Form 7200 in minutes with the IRS for $1.99/form.

When should I Fax IRS Form 7200?

The employer tax credits for qualified sick leave wages and qualified family leave wages to apply to those wages paid for the period from April 1, 2020, to December 31, 2020.

Businesses are allowed to file Form 7200 multiple times in a quarter. Still, the IRS does not allow the filing of Form 7200 after the federal tax return is filed- quarterly or annually.

Don’t file Form 7200 after file Form 941 for the fourth quarter of 2020 or file the annual federal tax returns Form 943, 944, or CT-1 for 2020. Also, don't file the form to request an advance payment for any anticipated credit for which you already reduced your deposits.

Paid Preparer

Form 7200 may be signed by a duly authorized agent of the taxpayer if a valid power of attorney has been filed.

A paid preparer must sign Form 7200 and provide the information in the Paid Preparer Use Only section if the preparer was paid to prepare Form 7200 and isn't an employee of the filing entity. The preparer must give you a copy of Form 7200 in addition to the copy to be filed with the IRS.

Frequently Asked Questions

Does my business qualify to receive the employee retention credit due to COVID-19?

Will the number of employees affects the credit on IRS Form 7200?

How is the credit on IRS Form 7200 calculated?

Which are the wages that qualify for employee retention credits on IRS Form 7200?

Can I claim advance tax credits using Form 7200 for Quarter 1, 2021?

Contact Us

Having any queries or concerns?

Our support team is ready to assist you all the time. Just contact us